A simple software solution for nonresident

tax

determination

filing

reclaim

withholding

compliance

determination

Global tax solutions, simplified

We’ve built a suite of solutions to help you navigate the complexities of nonresident tax

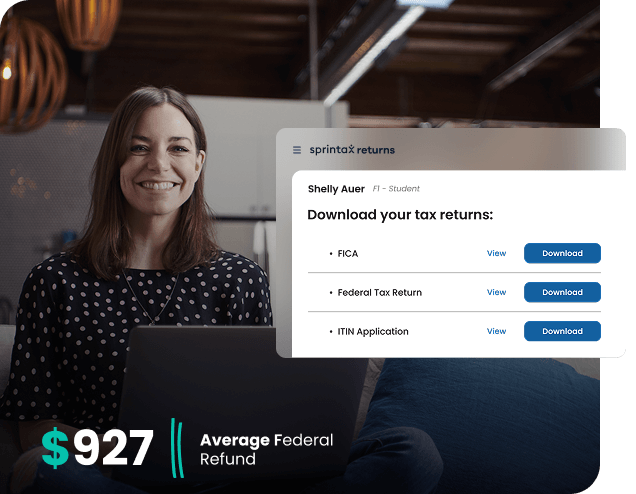

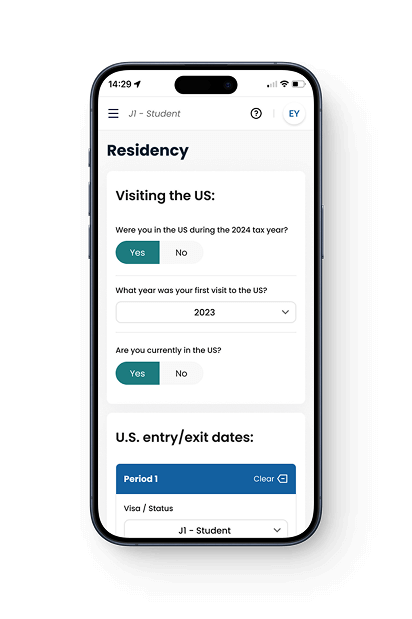

Fast & accurate US nonresident tax preparation

Sprintax Returns is the leading online federal e-filing and state tax return self-preparation software for US nonresidents. Each year, we help thousands of international students, scholars and short-term working visa participants to file their IRS compliant, US nonresident tax return. Sprintax is the nonresident partner of choice for TurboTax.

Learn More

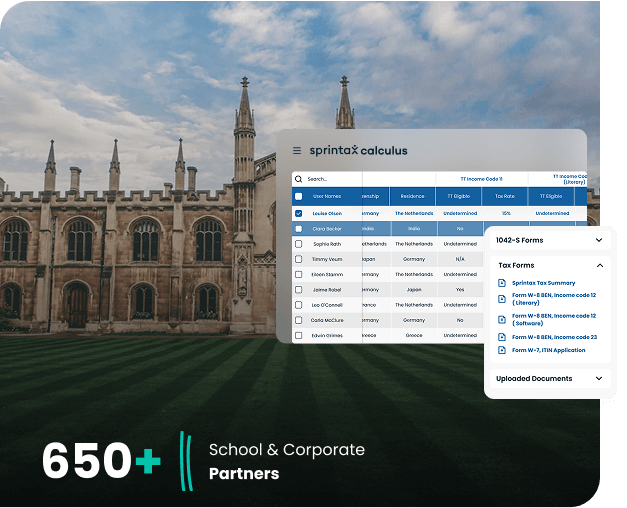

Tax determination & withholding for nonresident employees

Sprintax Calculus is the engine behind our multi-jurisdiction, tax compliance software which simplifies tax determination and withholding for organizations with international employees and vendors. Sprintax Calculus enables organizations to manage the tax profiles of their nonresident stakeholders on a single, user-friendly dashboard that seamlessly integrates with the leading US payroll solutions.

Learn More

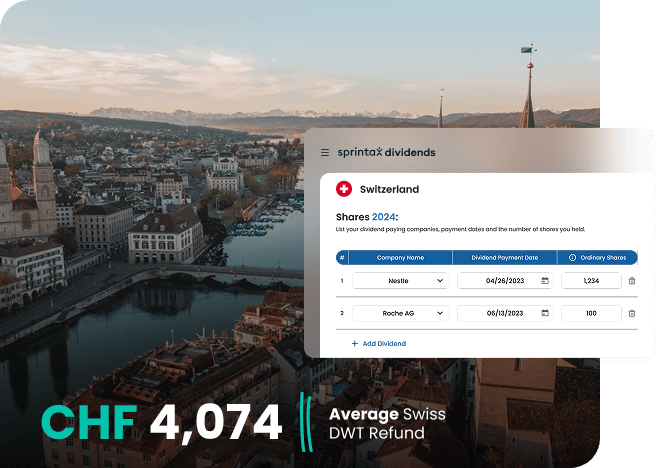

Simple tax reclaim on cross-border investments

Sprintax Dividends is a cross-border tax reclaim software solution which supports organizations and individual investors to maximise their return on investment by reclaiming dividend withholding tax (DWT), which is typically withheld on overseas investments.

Learn More

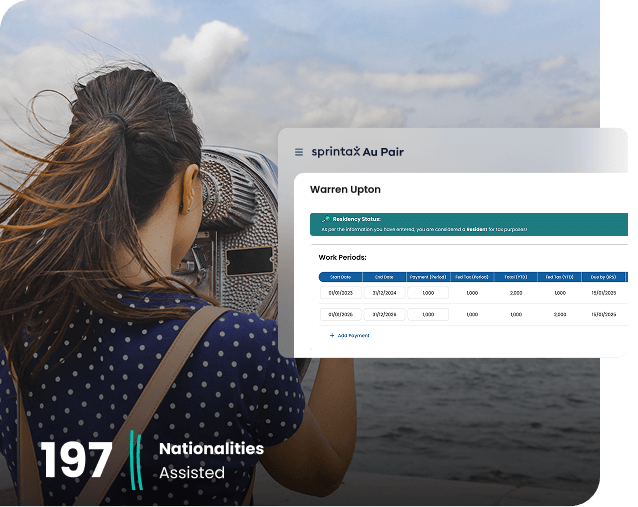

Au Pair Tax Calculator

Sprintax Au Pair simplifies US taxes for those working as Au Pairs. In just a few easy steps, calculate your federal withholding, plan your repayment schedule, and ensure full IRS compliance for the duration of your stay in the US.

Learn More

Why choose Sprintax?

Global tax compliance

Accurate tax determination, compliance and peace of mind for global employees.

Trusted software solutions

Market-leading, taxtech software that’s easy-to-use, with powerful API integration.

Reduced administration

Manage multiple tax profiles at once and streamline reporting with a unified dashboard.

Expert client supports

Dedicated, multi-channel supports tailored to your organizations needs.

Here’s what our customers think

Go to site for preparing tax returns!

Go to site for preparing tax returns for non-residents.

– User friendly

– Very helpful customer care representatives who answer the smallest of your queries even if it is a peculiar case or some silly doubt

– Partners with all major universities to let the students fill the federal return free of cost

This is my review after using Sprintax for 5th year in a row!!

Mark is great!

I have been struggling to pay my Federal Tax since April with different advisors trying their best to help. Finally today I was assisted by Mark who was nothing short of amazing! He sent me a solution which worked in seconds. Thank you so much Mark, you’ve relieved months of stress!

2nd time with Sprintax, 100% recommend! 2nd time processing my J-1 taxes and their service never failed me (got my last year’s refund already, now waiting for this year). Even their post-payment is amazing! Valentin helped me with all my questions and answered them in detail. Five-star service! This might be my last filing with them since I left USA already but 100% would recommend their services to any J-1 interns like me who want to file smoothly AND maximize their tax refund!

Partner with Sprintax

Managing nonresident tax compliance in your organization or curious about DWT reclaim on cross-border investments? Book a call with our partnerships team to get started with Sprintax.

Book a callTax determination

Determine residency status and tax treaty eligibility for your nonresident population.

Tax return preparation

Supporting US nonresident aliens with federal e-filing and state tax preparation.

Global DWT reclaim

Reclaim dividend withholding tax on overseas investments.

What our partners say?

Sprintax has been a welcome addition to the processing of our Institutions Non-Resident Alien (NRA) employees. The cloud-based software is user-friendly, and the knowledgeable support staff is quick to answer any questions you might have. NRA employees are able to submit all of their information and supporting documents for verification and Tax Treaty determination online. At year-end they are able to access their 1042S Forms via their online account and use TDS Sprintax to file their annual tax return if desired. Program views can be tailored to your needs and reports can be easily extracted for analysis and verification. Overall, Sprintax has proven to be an effective way to efficiently maintain our NRA employee files in a cost-effective manner.

The partnership we have with Sprintax has been one of the best decisions for our students and office. Feedback and working with them personally has shown us the Sprintax team is very knowledgeable, courteous, and always willing to lend a helping hand. We saw an increase in the number of students filing both their federal and state tax returns, which is in large part due to Sprintax’s efforts in providing us with useful resources as well as hosting webinars for our students. I cannot imagine a better tax preparer for our international community.

Sprintax Returns has completely transformed tax season for DePauw undergraduates. More students submit their returns–and on time–than ever before! This is credit to the Sprintax software but also to the amazing Sprintax team, who are a constant source of support, always quick to reply and help troubleshoot any questions that come up. I can’t recommend Sprintax enough. It’s a wonderful solution for making sure that international students fulfil their tax obligations, simplifying a notoriously challenging process and making it almost easy!

Ready to get started?

Contact us today to see how we can transform nonresident

tax compliance for your organization