File your US nonresident tax return

Sprintax Returns is the leading online solution for nonresident federal tax e-filing and state tax return preparation

How does Sprintax Returns help?

Each year, we help thousands of international students, scholars and short-term working visa participants to file their tax return. As the nonresident tax partner of TurboTax, we ensure your tax documents are accurate and 100% IRS-compliant.

Managing nonresident tax compliance at your institution? Join the 700+ organizations that partner with Sprintax annually and gain access to a wealth of supports including on-site tax workshops, Q&A webinars, tax filing guides & more!

700+

School & corporate partners

1m+

Federal tax returns filed

$135m

in federal refunds issued annually

95%

would recommend Sprintax to their friends

Fuss-free filing

01

Create your account

Create your Sprintax Returns account here.

02

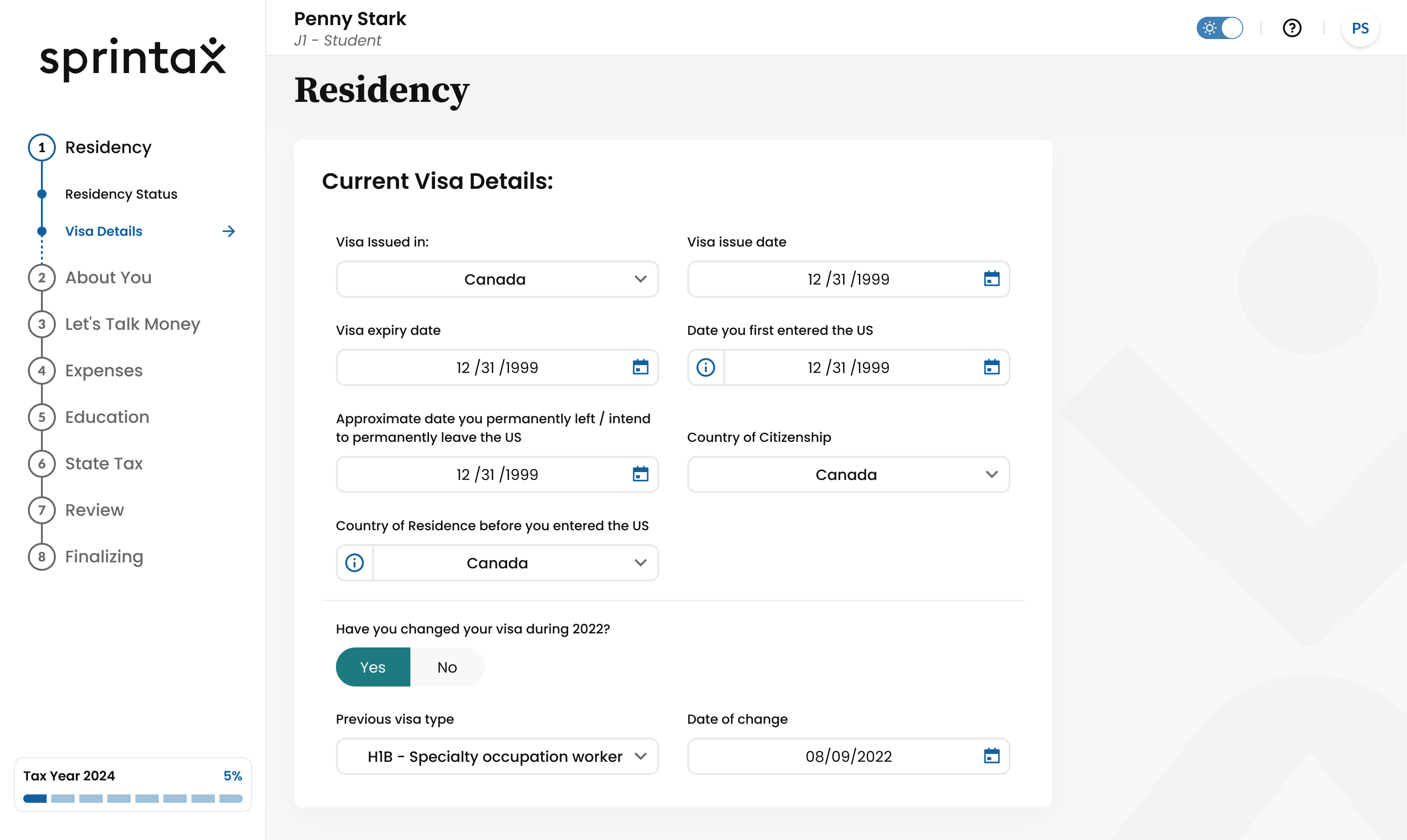

Tell us about you

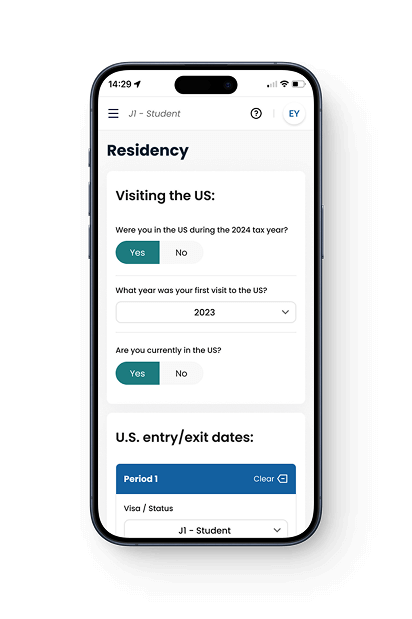

Provide details about your tax residency, visa program and planned stay in the US by answering a few quick questions.

03

We’ll check your tax treaty eligibility

Our software has a built-in knowledge of nonresident tax laws and automatically applies all tax treaty benefits, credits and reliefs.

04

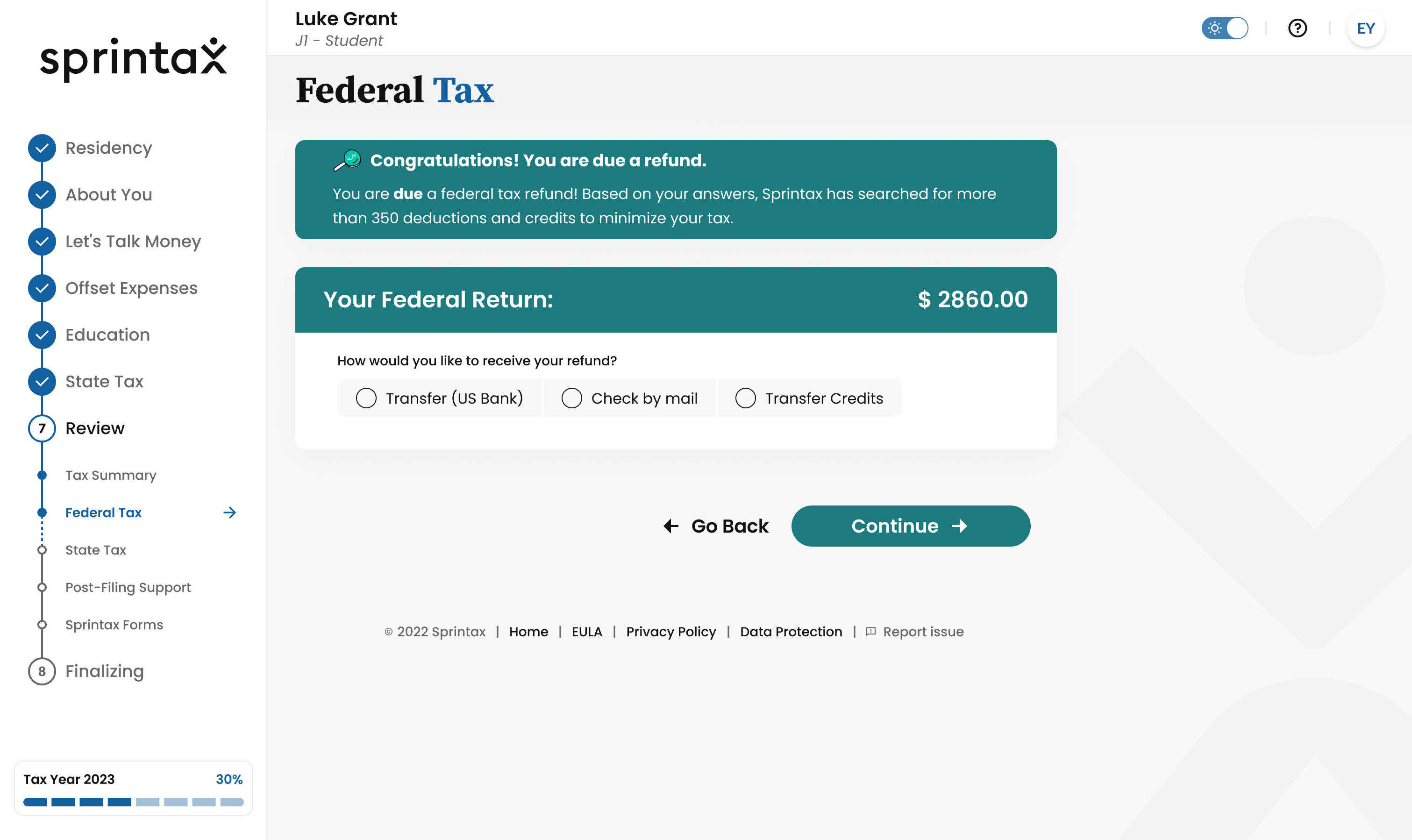

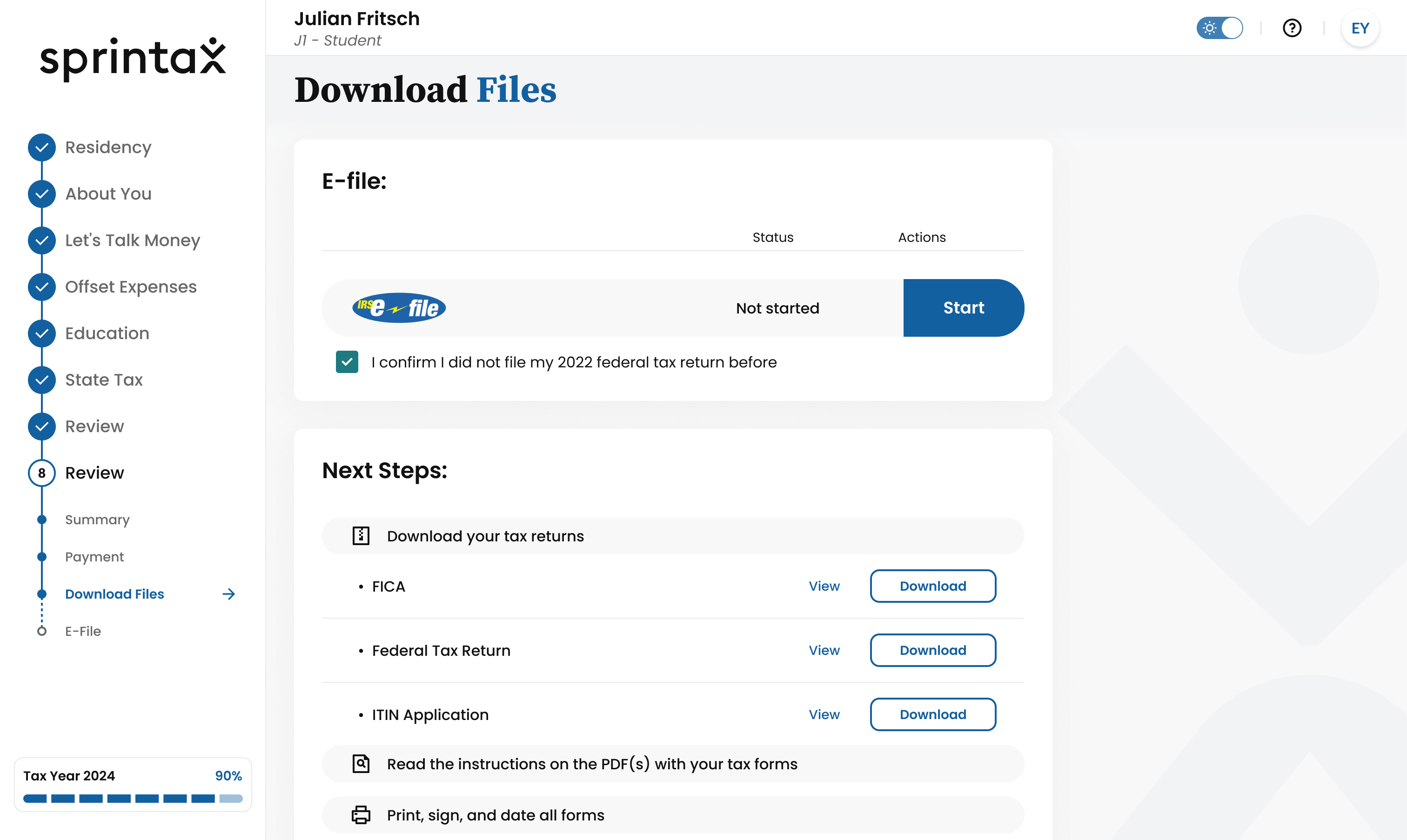

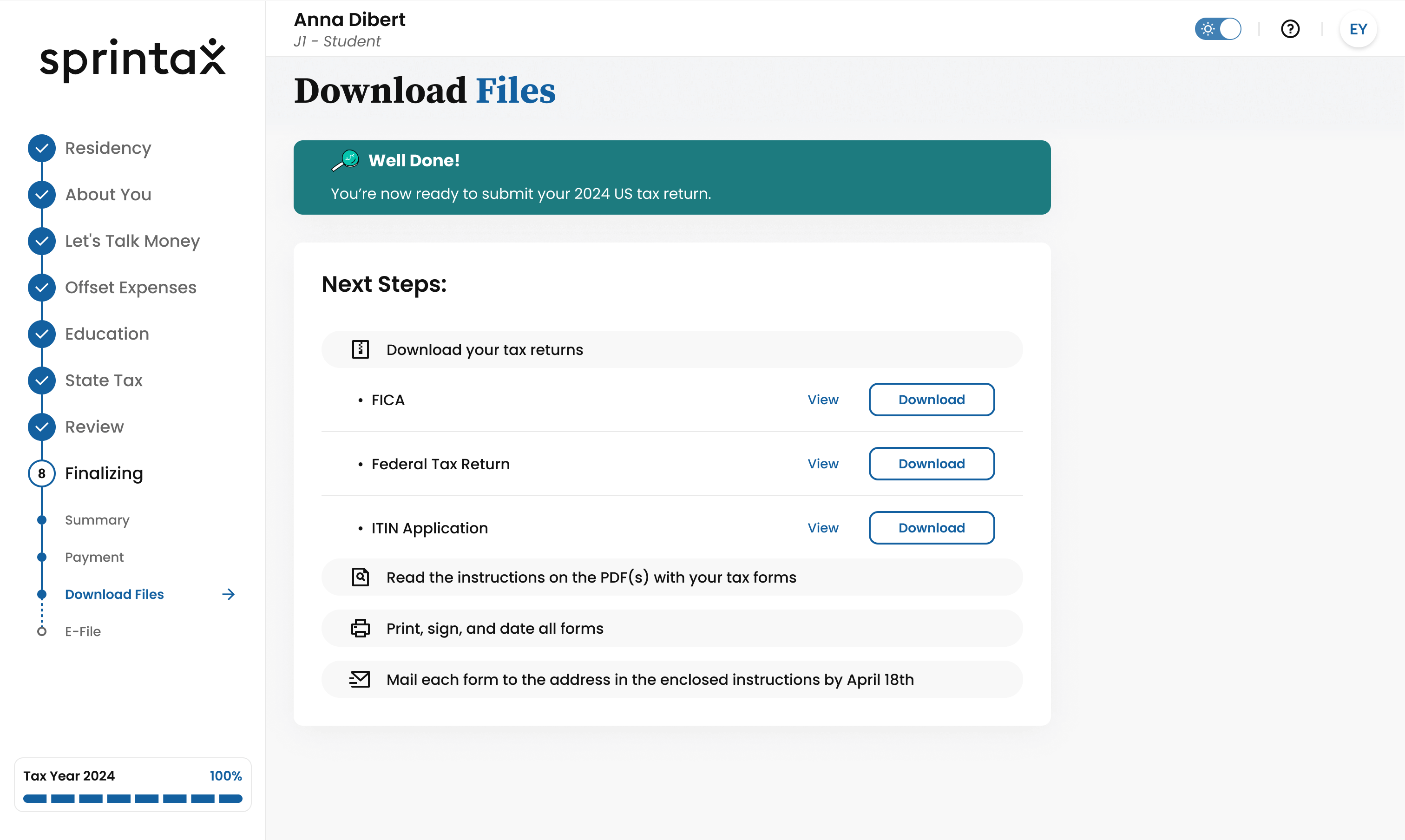

E-File your federal return

Eligible nonresidents can e-file their federal return. All other users can download and mail their completed forms to the IRS.

05

Print , sign and mail your state return

If you need to file a state return or two, our software will prepare the completed tax forms, ready for download with mailing instructions.

Who can file with Sprintax Returns?

If you are living in the US on a temporary visa, like an F-1 or J-1, you must comply with US tax requirements including filing a federal tax return. Depending on your state residency, you may also need to file a state tax return. Even if you had no income, filing a Form 8843 is mandatory to remain compliant. Sprintax supports:

International Students

J1 Work & Travel Participants

J1 Interns & Trainees

Au Pair & Camp Counselors

Royalty Recipients

Why file with Sprintax Returns?

Maximise your refund

Our software will apply all eligible tax treaty benefits, credits and reliefs so you don’t pay any more tax than you need to.

Federal e-filing

Many nonresidents will be able to e-file their federal tax return with Sprintax Returns.

Trusted by TurboTax

As the nonresident partner of TurboTax, we will ensure you are taxed correctly, keeping you compliant with the IRS.

‘Round-the-clock support

Have tax questions? The Sprintax Live Chat team is available to support you.

Tax Forms

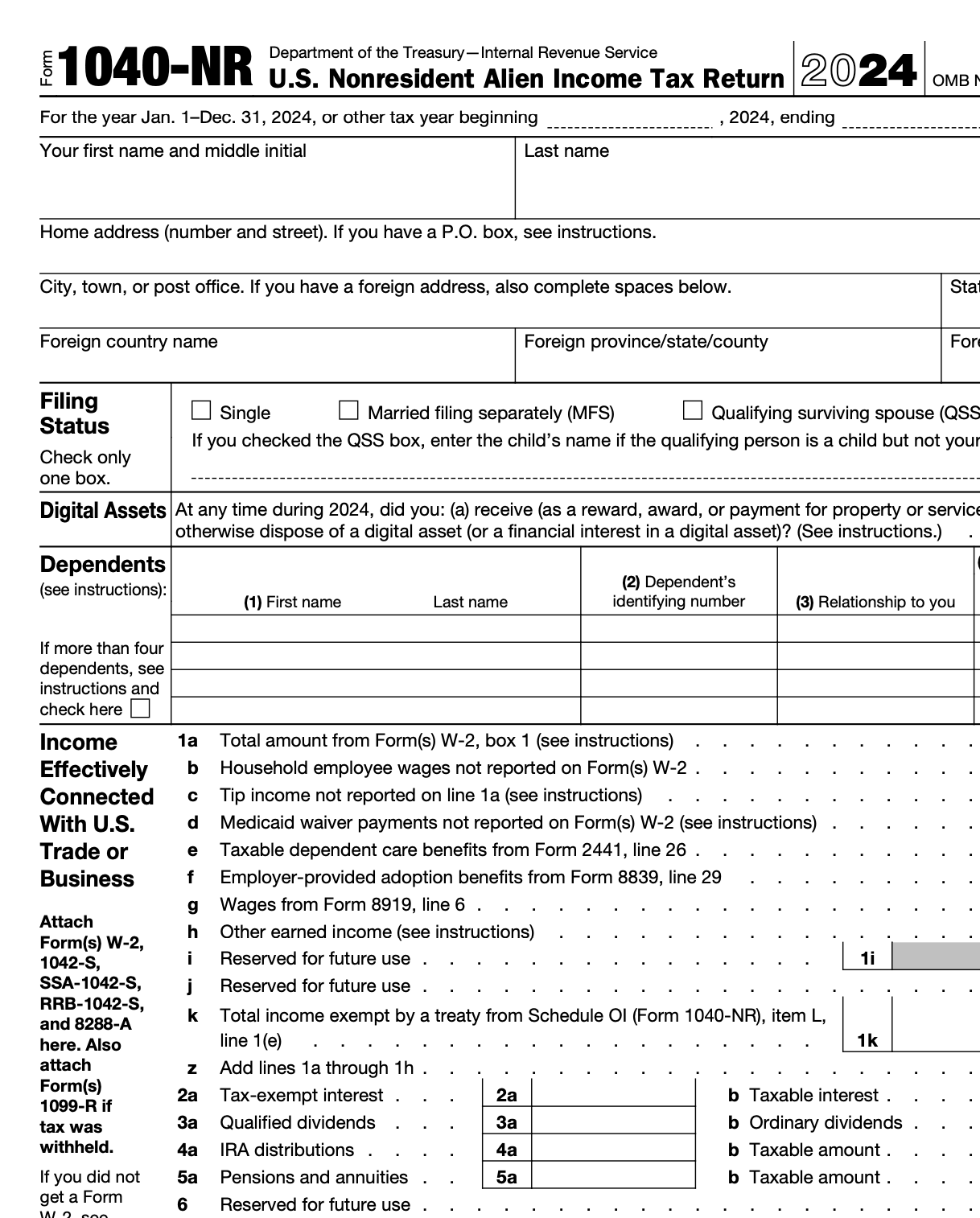

Form 1040-NR

Form 1040-NR, US Nonresident Alien Income Tax Return is the federal tax return that nonresidents should file to account for the income earned in the previous tax year.

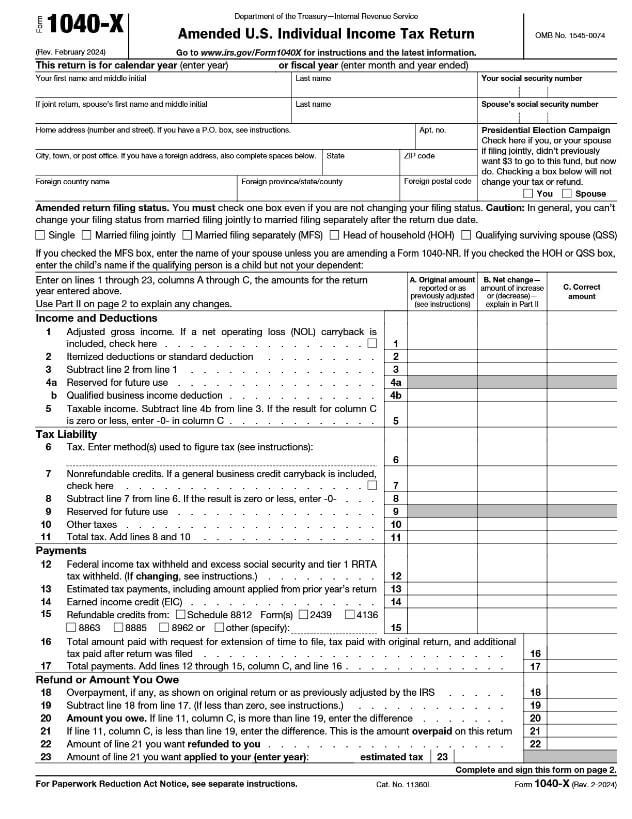

Form 1040X

Form 1040-X, Amended U.S. Individual Income Tax Return is used to claim additional deductions or credits or to correct an error on a previously filed tax return, which has reduced the amount of tax the taxpayer owed for that year.

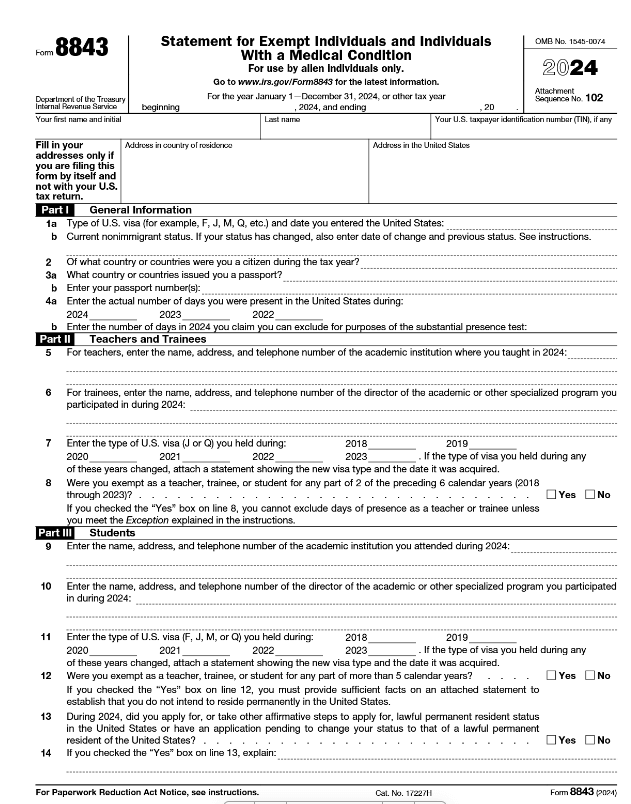

Form 8843

Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition is used by nonresident aliens who wish to exclude days present in the US for the purposes of the Substantial Presence Test, either because they were an exempt individual or they were unable to leave the US due to illness. Nonresidents are also required to file this document if they received no income during the tax year.

Here’s what our customers think

I had a great experience using Sprintax. The response time was very efficient, and the support provided was extremely helpful. When I had questions, they provided detailed corrections in clear sections, making it easy to understand and resolve any issues. Highly recommend!

The staff were extremely helpful and sorted out my tax issues for me. I moved states halfway through the year, which caused my state tax declaration to be very complicated and initially turned out incorrect. After correspondence with the staff, the Sprintax tax experts prepared all the correct paperwork for me and saved me a lot of money. Everybody I interacted with was very friendly and helpful. Huge thanks to Kate, Valentin, Stefan and Nadezhda for all the help.

I’m a Fulbright scholar for 2024, funded by the IIE. Since I don’t have an SSN or ITIN, Allison was incredibly helpful in explaining the tax filing process while I’m still in my home country. She addressed many of my concerns and has assured me that she’ll continue to assist me once I receive my tax documents from the IIE.

Partner with Sprintax Returns

Managing nonresident tax compliance in your school or organization? Book a call with our partnerships team to get started with Sprintax Returns.

Book a CallSave time for your team

Outsource your tax queries to Sprintax. Our team will be happy to guide your nonresidents through the tax filing process.

Simple online process

International employees and students can easily prepare their nonresident federal, state & FICA tax returns, Form 8843 and ITIN applications.

Expert Support

We provide a range of support materials including Q&A webinars, tax filing guides and 24/7 live chat support.

What our partners say?

Sprintax has been a welcome addition to the processing of our Institutions Non-Resident Alien (NRA) employees. The cloud-based software is user-friendly, and the knowledgeable support staff is quick to answer any questions you might have. NRA employees are able to submit all of their information and supporting documents for verification and Tax Treaty determination online. At year-end they are able to access their 1042S Forms via their online account and use TDS Sprintax to file their annual tax return if desired. Program views can be tailored to your needs and reports can be easily extracted for analysis and verification. Overall, Sprintax has proven to be an effective way to efficiently maintain our NRA employee files in a cost-effective manner.

The partnership we have with Sprintax has been one of the best decisions for our students and office. Feedback and working with them personally has shown us the Sprintax team is very knowledgeable, courteous, and always willing to lend a helping hand. We saw an increase in the number of students filing both their federal and state tax returns, which is in large part due to Sprintax’s efforts in providing us with useful resources as well as hosting webinars for our students. I cannot imagine a better tax preparer for our international community.

Sprintax Returns has completely transformed tax season for DePauw undergraduates. More students submit their returns–and on time–than ever before! This is credit to the Sprintax software but also to the amazing Sprintax team, who are a constant source of support, always quick to reply and help troubleshoot any questions that come up. I can’t recommend Sprintax enough. It’s a wonderful solution for making sure that international students fulfil their tax obligations, simplifying a notoriously challenging process and making it almost easy!

Your questions, answered

A nonresident alien (NRA) is any individual who is not a US citizen or US national, who does not pass the substantial presence test or the green card test. You can determine your residency status for free with Sprintax Returns. Simply create an account here to get started.

Sprintax Returns was created specifically for nonresident professionals, international students, scholars, teachers and researchers in the US on F, J, M and Q visas. Our software makes it easy for all nonresidents to prepare their US taxes online and stay compliant with IRS tax rules.

Yes. Sprintax is approved by the IRS for federal tax e-filing and many nonresidents will be able to file their 1040-NR tax return without ever having to leave the comfort of their own home!

There are many reasons why you may need to amend your US income tax return. Whatever your tax situation, you can easily amend your tax documents online with Sprintax Returns. To prepare form 1040-X, just create your Sprintax account here or login to get started.

After you file your taxes, it’s possible the IRS may contact you to request some additional documents. While dealing with the tax office is not always easy, the good news is that Sprintax can support you with any additional paperwork required. By signing up for the Sprintax Post-Filing Service, you can request that all additional communication with the IRS is managed by our tax experts on your behalf.

Ready to get started?

File your US nonresident federal and state tax return with Sprintax today

Get Started