US tax preparation for organizations with nonresident

employees and students

We file over 120,000 nonresident tax returns with the IRS each year!

Request a Demo

How Sprintax Returns can help

Sprintax Returns is an easy-to-use system that your international employees and students will love.

In fact, 90% of our users say they would recommend Sprintax to their friends! Our system makes it easy for your nonresidents to file their taxes, claim their tax refund and remain IRS-compliant.

Sprintax Returns is great value too. We offer affordable packages to our partners with built-in support for employees and students.

Key Features

Federal E-Filing

We are LIVE for nonresident federal tax return E-filing!

Automatic generation of completed tax forms

International employees and students can easily prepare their Federal, State & FICA tax returns, Form 8843 and ITIN applications.

Simple online process

Sprintax Returns has built-in knowledge of nonresident tax laws and automatically applies all tax treaty benefits, credits and reliefs to each tax return. Nonresidents can also claim their maximum federal, state and Medicare refund without stress.

Save time for your team!

Outsource your tax queries to Sprintax. Our team will be happy to guide your nonresidents through the tax filing process.

Peace of mind

When filing with Sprintax Returns, your nonresidents can guarantee that they are 100% tax compliant with the IRS.

Around the clock support for your nonresidents

We provide a range of support materials including Q&A webinars, tax filing guides and 24/7 live chat support.

We’re the name for nonresident tax!

Sprintax is the nonresident partner of choice for TurboTax. To date, we have partnered with more than 450 organizations in the US – including 8 of the top 10 universities!

How It Works

01

Meet the team and discuss your requirements!

02

Share a link to your dedicated Sprintax portal with your nonresident population

03

Arrange your on-site or virtual tax workshop and access our tax communications kit

04

Direct any tax related queries or concerns to Sprintax 24/7 live chat and support

05

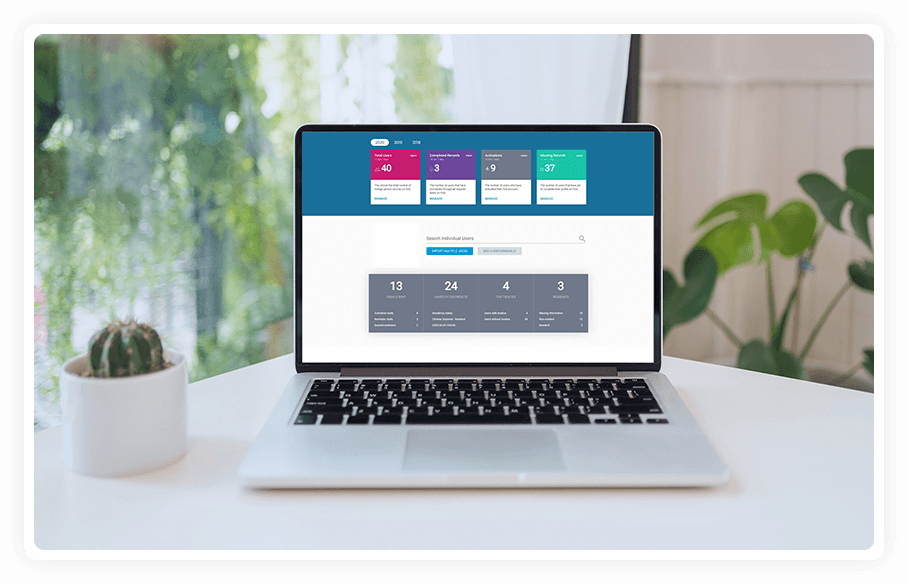

Access dynamic reports on tax compliance in your organisation

Here is what our customers Think

” The partnership we have with Sprintax has been one of the best decisions for our students and office. Feedback and working with them personally has shown us the Sprintax team is very knowledgeable,

courteous, and always willing to lend a helping hand. We saw an increase in the number of students filing both their federal and state tax returns, which is in large part due to Sprintax’s efforts in

providing us with useful templates and resources as well as hosting webinars for our students. I cannot imagine a better tax preparer for our international community. “

Tyria Newman,

Programs Assistant at Kettering University

Frequently Asked Questions

Our system has been developed specifically to support nonresident professionals, international students, scholars, teachers and researchers in the US on F, J, M and Q visas.

Sprintax Returns makes it easy for all nonresidents to prepare their US taxes and comply with IRS rules and regulations.

Every nonresident in the US is required to file tax documents with the IRS – even if they have not earned an income.

By partnering with Sprintax Returns, you can help your international employees and students to file their taxes and ensure they’re IRS compliant.

By completing the Sprintax questionnaire, nonresidents can easily prepare every US tax document they need including federal, state & FICA tax returns, Form 8843 and ITIN applications.

Yes. Many nonresidents will be able to E-File their Federal tax return with Sprintax. Where a user is not eligible to E-File, they can simply download their completed forms and mail them to the IRS.

Yes. Nonresidents can easily amend their tax documents online with Sprintax Returns. To amend a tax return, a user must simply login to their account and select the year they would like to amend.