Au Pair

Tax Calculator

Sprintax Au Pair is specifically designed to help US Au Pairs estimate their federal tax withholding and plan their IRS payment schedule

How does Sprintax Au Pair help?

We know that navigating the US tax system as a first-time filer can be challenging—especially for Au Pairs who don’t have taxes withheld at source. That’s where Sprintax Au Pair comes in. With just a few simple steps, we’ll calculate your federal tax liability and help you set up a manageable repayment plan, ensuring full IRS compliance and peace of mind throughout your stay in the US.

As simple as

A, B, C

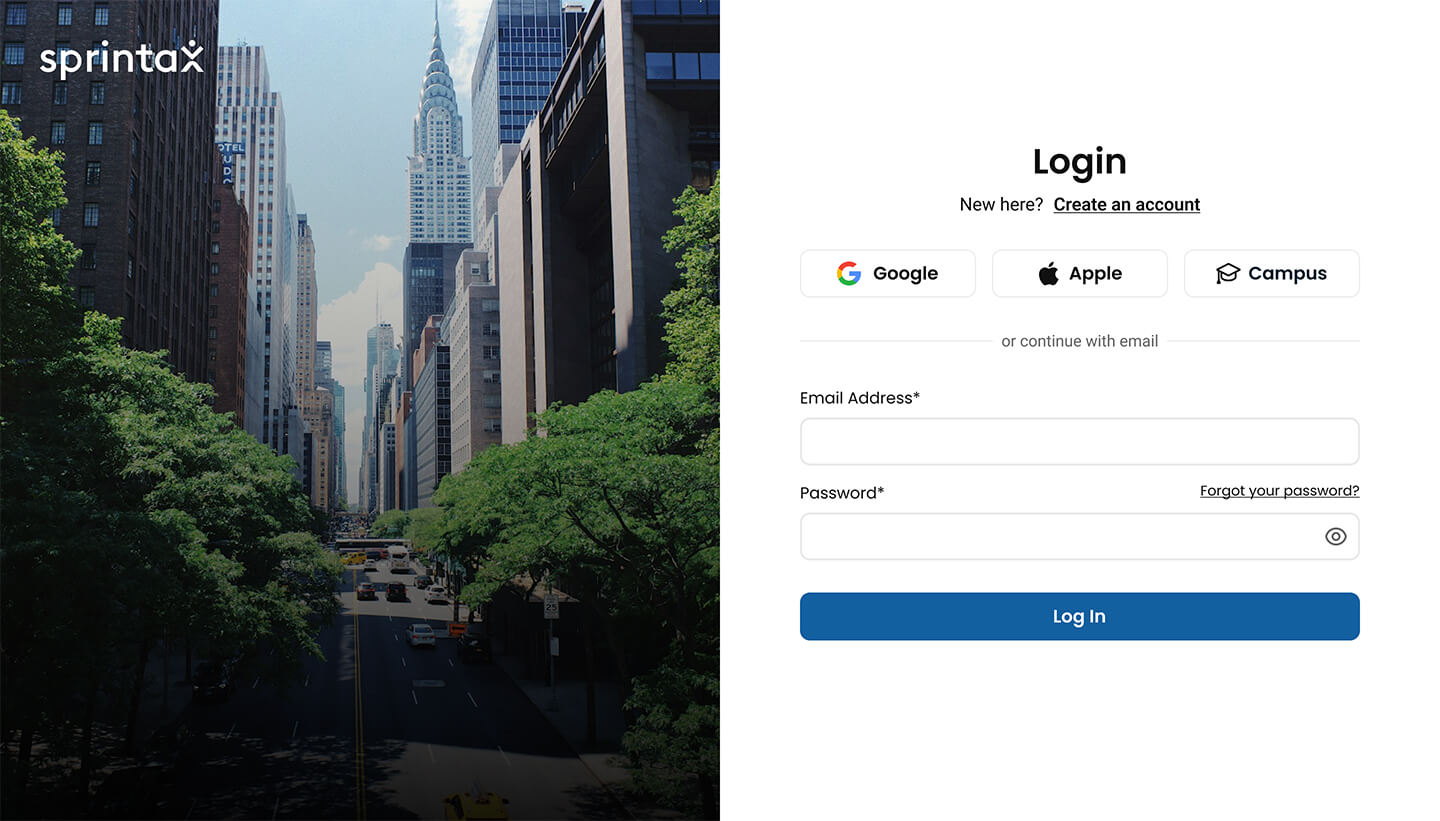

01

Create your account

Create your Sprintax Au Pair account here.

02

Tell us about you

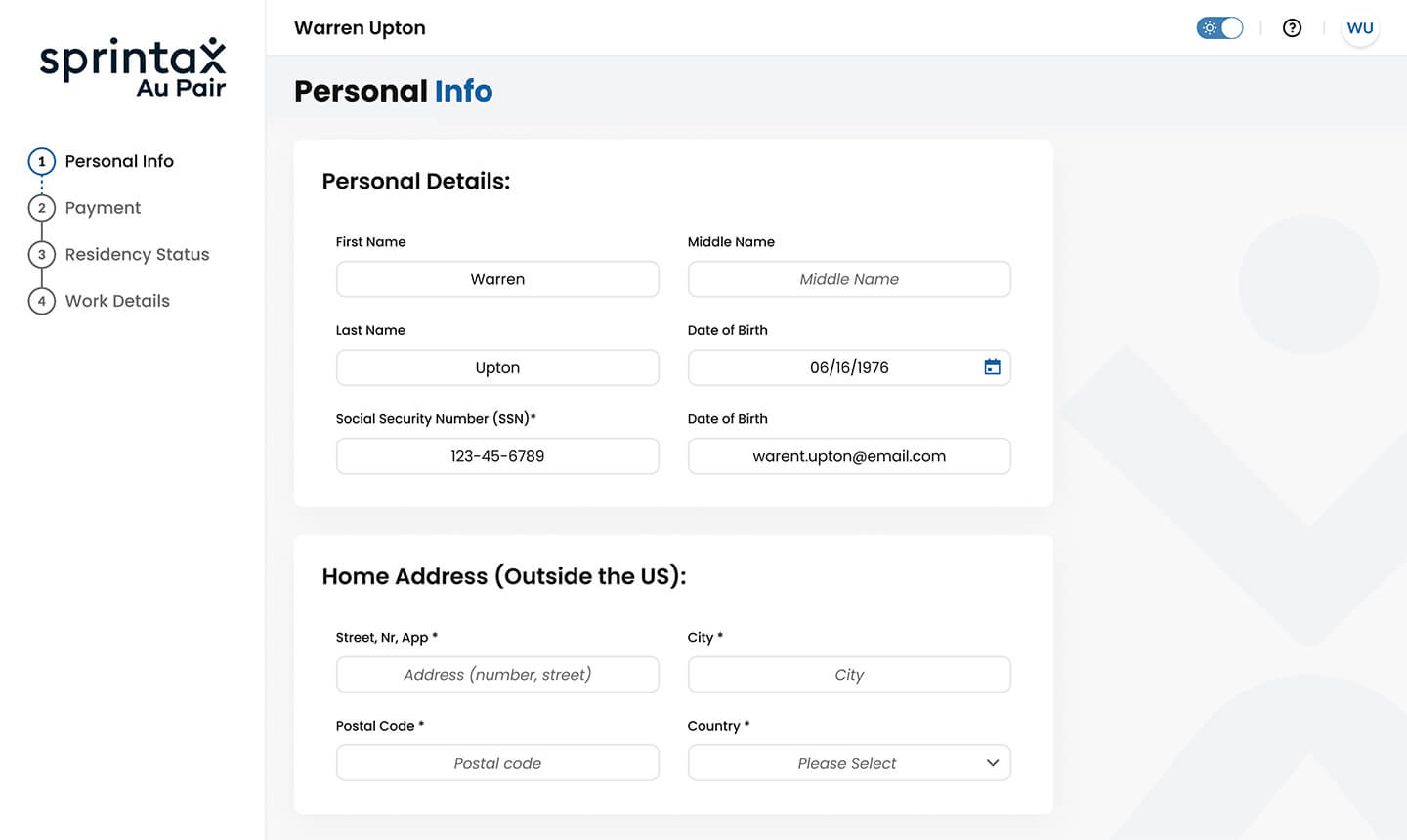

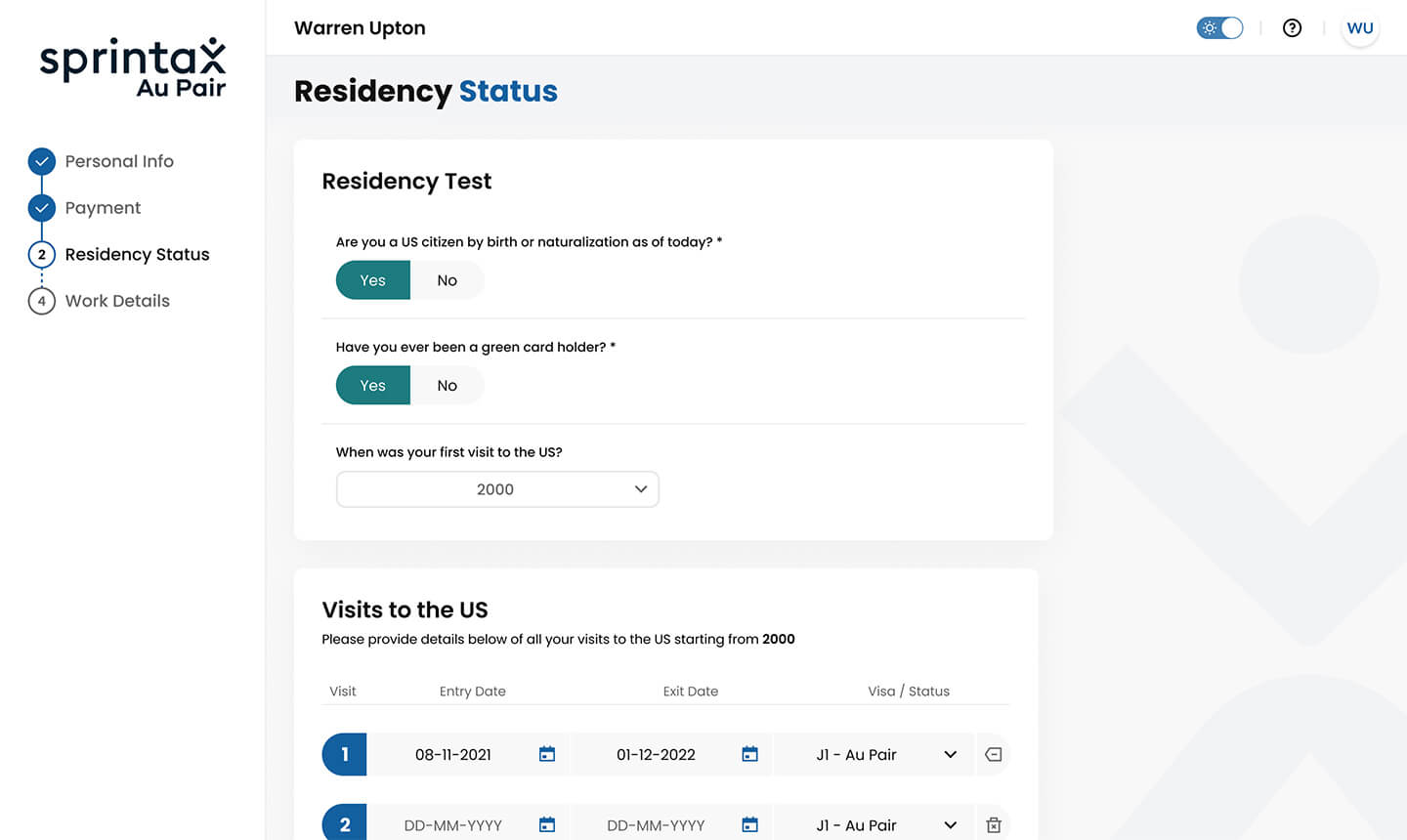

Provide details about your visa program, host family, and planned stay in the US by answering a few quick questions.

03

We’ll run the numbers

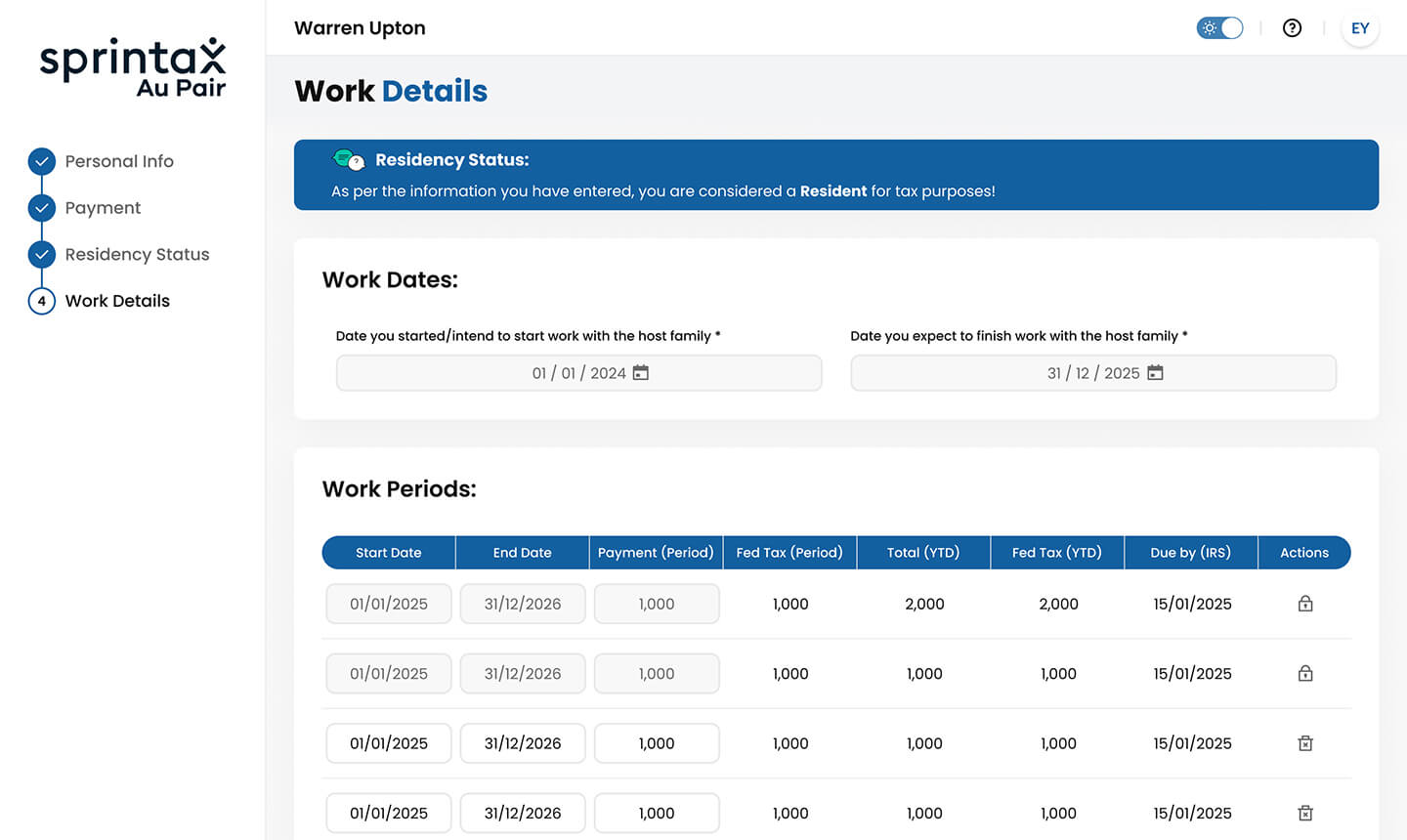

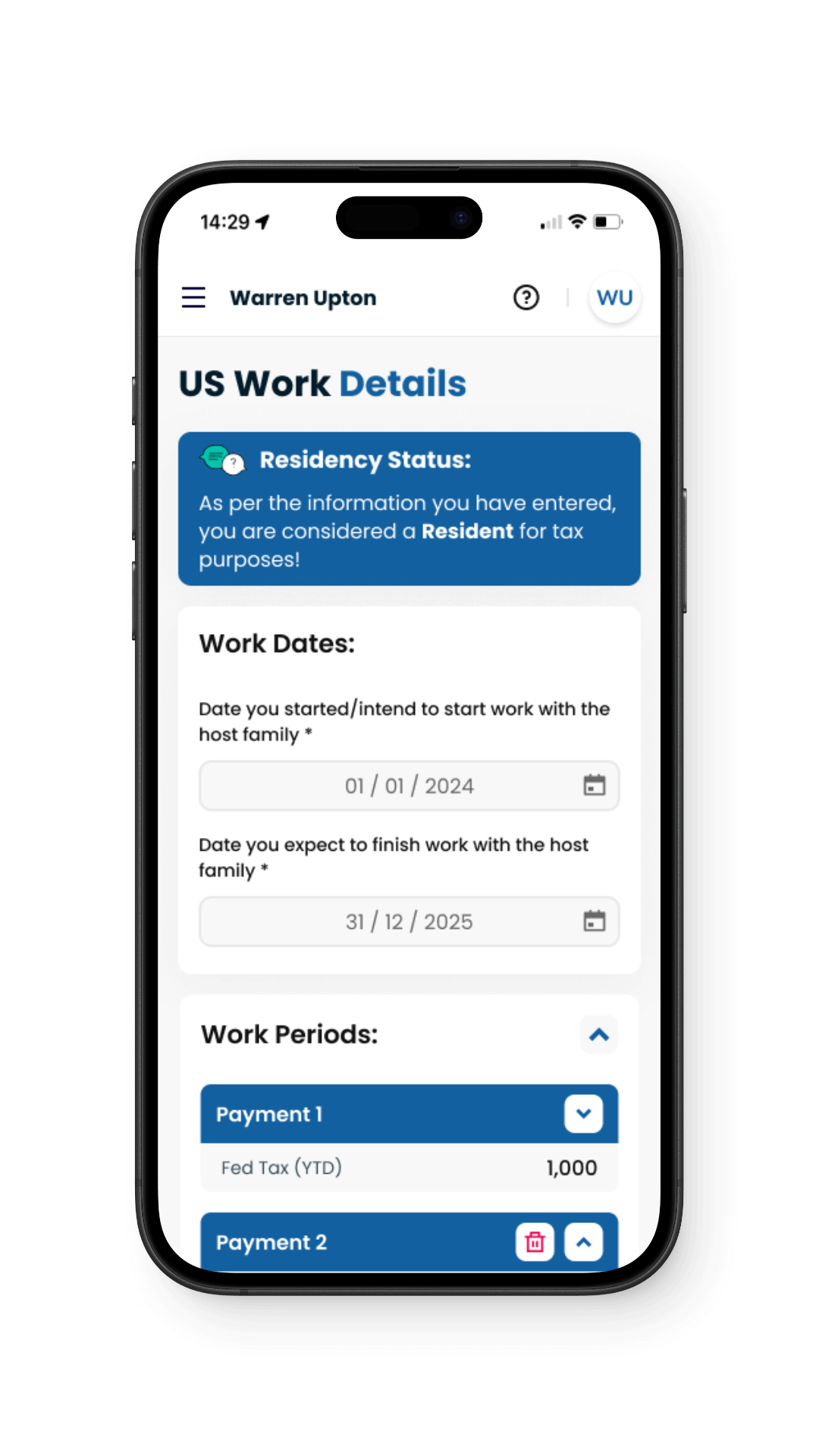

The software will determine your tax residency status, check for tax treaty eligibility, and estimate your quarterly tax repayments.

04

Schedule your IRS payments

Set your IRS payment schedule and track your progress via the dashboard.

Why choose Sprintax Au Pair?

No surprise tax bills

Sprintax Au Pair helps you pay estimated taxes in manageable installments.

Save more with Sprintax

Determine your tax residency status to find out if you qualify for tax treaty exemptions.

Tax compliance not confusion

We’ll ensure you are taxed correctly, keeping you compliant with the IRS.

‘Round-the-clock support

Have tax questions? The Sprintax Live Chat team is available to support you.

Your questions, answered

Yes, Au Pairs are required to pay taxes on every dollar earned. Even if you had no income, you must still file Form 8843.

Most Au Pair won’t receive a W-2. Since they are compensated for work in a private home setting, their earnings are not subject to mandatory US income tax withholding or reporting on Form 941 and W-2.

Yes, you will need an SSN to file your tax return. You will typically apply for one once you arrive in the US.

Depending on the state where you reside, you may be required to file a state tax return. You can file your state return with Sprintax Returns here.

Yes, if Au Pairs do not pay their estimated taxes throughout the year, they could face a hefty tax bill when filing their return. That’s where Sprintax Au Pair comes in! Our software allows you to report your earnings and make gradual tax payments, helping you avoid a large lump sum at tax time.

In order to calculate your estimate IRS payments, you’ll need your Social Security Number (SSN) and the total payments received from your host family up to the quarterly submission date.

Yes! Au Pairs can file their tax return with Sprintax, regardless of how many states they’ve worked in. We recommend using Sprintax Au Pair for quarterly tax estimates, then file your annual return seamlessly with Sprintax Returns.

If an Au Pair fails to pay taxes, they may face penalties—typically 5% of the owed tax for each month or partial month the return is late. Additionally, non-payment could lead to difficulties obtaining a US visa in the future.

Yes! If you’re a nonresident, you can use Sprintax Returns to easily file your annual tax return. If the Substantial Presence Test determines you’re a resident for tax purposes, we’ll direct you to our partners at TurboTax.