Starting a new job in the US?

Get taxed correctly from the start!

Correctly prepare the pre-employment tax forms

(W-4, 8233, W-8BEN and more) with Sprintax Forms

Price from $19.95

Get started

Why Choose

Sprintax Forms?

When you start a new job in the US, your employer will ask you to complete some important tax documents. These documents will determine how much tax is deducted from your wages.

Don’t pay any more tax than you need to. Prepare the employment forms you need easily online with Sprintax Forms.

Prepare the employment forms you need easily online

Automatically generate the pre-employment tax forms you need, such as the W-4, 8233, W-8BEN and more.

Pay the correct amount of tax

You can easily determine your tax residency status so that the right amount of tax is withheld from your salary.

Avail of your tax treaty benefits

Sprintax Forms will ensure you receive every tax treaty benefit you’re due. We will also help you to identify if you are exempt from FICA taxes.

24/7 support!

Got questions about your forms? No problem! Our live chat team are here to support you 24/7.

How It Works

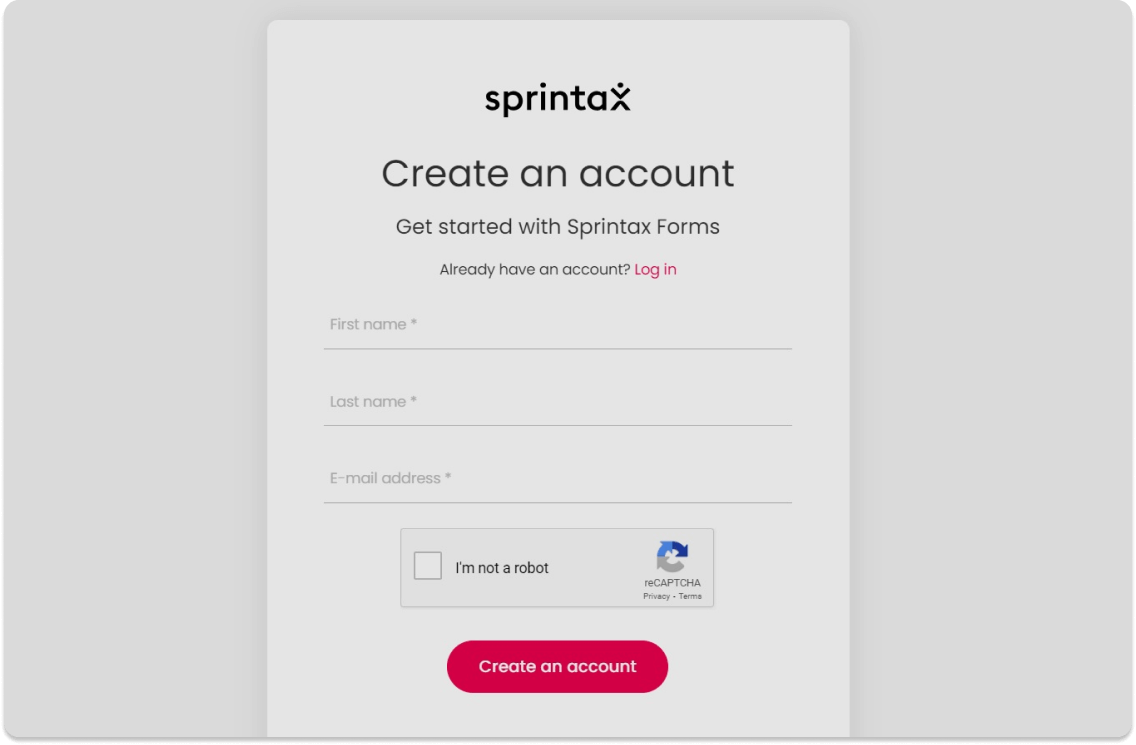

01 - Create your account

To get started, simply enter your name and email address to create your Sprintax account.

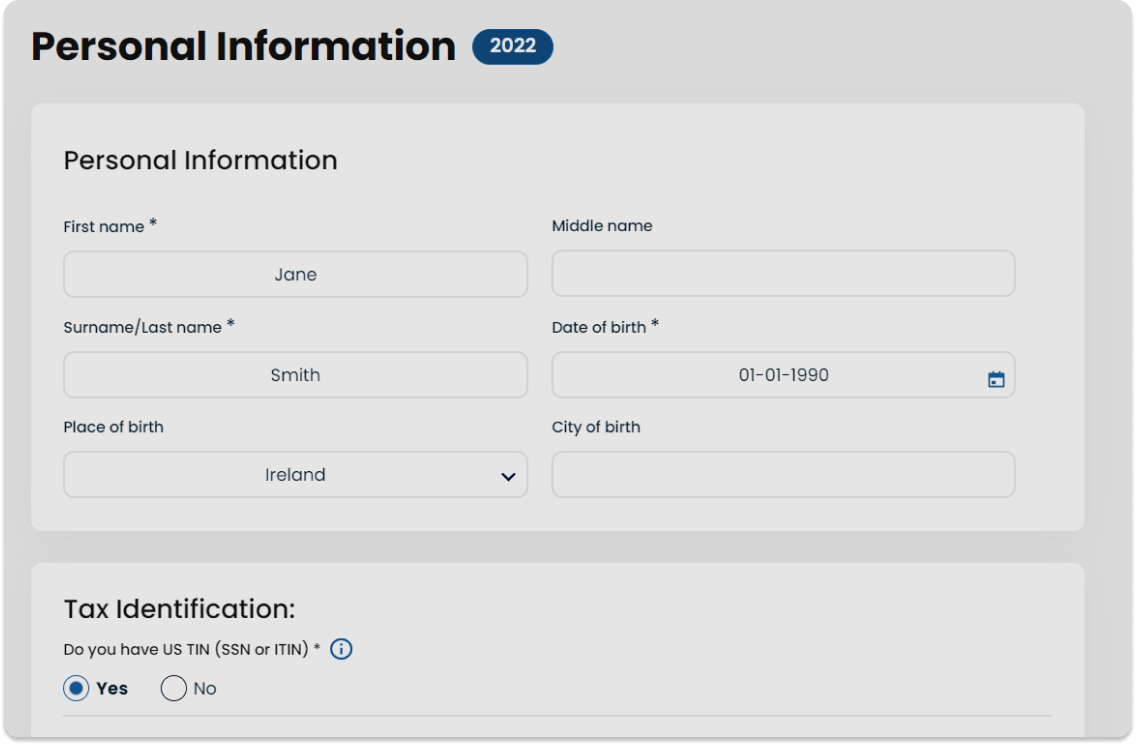

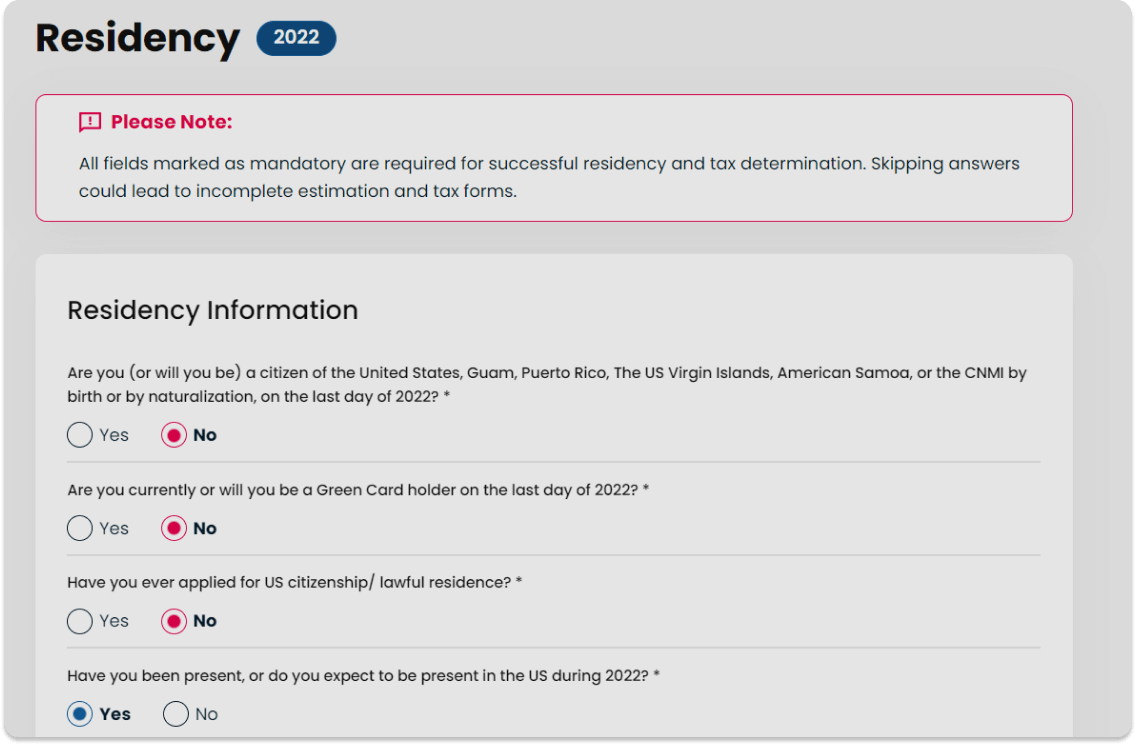

02 - Tell us about yourself

Quickly complete our user-friendly online questionnaire.

03 - Tax profile determination

We determine your residency status, tax treaty eligibility and generate the tax forms you need, such as your W-4, 8233, W-8BEN and more.

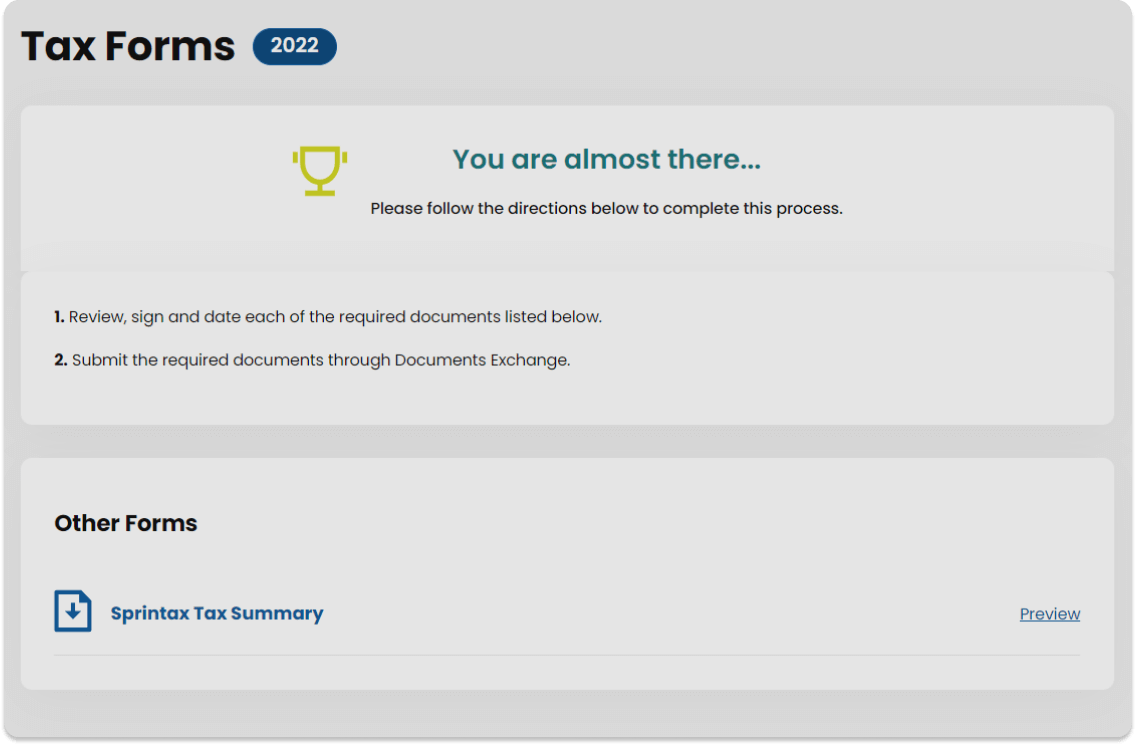

04 - Download your completed forms

Download, print and sign your new US tax forms and give them to your employer.

Who Can use Sprintax Forms?

International Students & Scholars

Sprintax helps thousands of international students with their tax documents every year.

So if you’re in the US as an international student and you are starting a new job (including an OPT or CPT position), we can help you to prepare every income document you will need for your employment.

J1 Work & Travel

Worried about completing your US employment forms?

Sprintax helps thousands of J1 participants with their taxes every year!

We’ll ensure that the correct amount of tax is deducted from your wages and that your tax treaty benefits are applied to your salary.

Interns & Trainees

If you are earning income in the US by participating in a training programme or internship, you can easily prepare the employment documents you need online with Sprintax Forms.

Au Pair & Camp Counselors

Sprintax Forms is a user-friend system which helps Au Pairs & Camp Counselors to prepare every employment document needed to work in the US.

Create your Sprintax account today to get started.

Royalties

Earning royalty income from work you have performed in the US? Sprintax Forms will help you to prepare every document you need to ensure you pay the correct amount of tax on your earnings.

Create your Sprintax account today to get started.

Other

Sprintax Forms was created specifically to help nonresidents in the US to avoid paying too much tax on your wages.

No matter what your tax situation, we will ensure that you claim every tax deduction and tax treaty benefit you’re entitled to.

Create your Sprintax account today!

Tax Forms

Pre-employment paperwork and tax documents generated by Sprintax Forms

Form W-4

Every nonresident working in the US must complete a W-4 when starting a new job.

This form is used to determine exactly how much tax should be withheld from the nonresident’s paycheck.

Form W-8BEN

Nonresidents can potentially reduce their tax liability by claiming tax treaty benefits. In order to avail of a treaty relief, nonresidents must complete a form W-8BEN.

Form W-8BEN-E

By completing a Form W-8BEN-E (also known as a Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting), foreign vendors can claim a reduction in tax by availing of tax treaty benefits.

Form 8233

Every nonresident who earns a certain type of scholarship, personal services or fellowship income (including compensatory scholarship or fellowship income from the same withholding agent) is required to file a Form 8233. This form can also be used to claim exemption from withholding for certain personal services, because of an income tax treaty.

Form W-7

This form is used by nonresidents who are not eligible for a Social Security Number and need to apply for an Individual Taxpayer Identification Number (ITIN) to file a federal tax return.

Form W-9

Form W-9 is used to provide and certify a Taxpayer Identification Number (TIN) and to verify that the nonresident is not subject to backup withholding.

Form SS-5

Nonresidents use this form to request a social security card.

Here's What Our Customers Think

Go to site for preparing tax returns for non-residents.

- User friendly

- Very helpful customer care representatives who answer the smallest of your queries even if it is a peculiar case or some silly doubt

- Partners with all major universities to let the students fill the federal return free of cost

This is my review after using Sprintax for 5th year in a row!!

Mark is great! I have been struggling to pay my Federal Tax since April with different advisors trying their best to help. Finally today I was assisted by Mark who was nothing short of amazing! He sent me a solution which worked in seconds. Thank you so much Mark, you’ve relieved months of stress!

2nd time with Sprintax, 100% recommend! 2nd time processing my J-1 taxes and their service never failed me (got my last year’s refund already, now waiting for this year). Even their post-payment is amazing! Valentin helped me with all my questions and answered them in detail. Five-star service! This might be my last filing with them since I left USA already but 100% would recommend their services to any J-1 interns like me who want to file smoothly AND maximize their tax refund!

Frequently Asked Questions

Sprintax Forms can help you to prepare every form you need when starting a new job as a nonresident in the US. This includes forms W-4, 8233, W-8BEN and more.

From W-4

The purpose of this form is to determine how much tax should be withheld from your income. It’s very important that this form is completed correctly. When you create your Sprintax account, our software will ensure you complete your W-4 correctly and that you pay the right amount of tax on your income.

Form 8823

This form is used to claim a tax treaty-based exemption from tax withholding on personal services income.

Form W-8BEN

This form proves your status as a nonresident alien and determines your eligibility for tax treaty benefits on Fixed, Determinable, Annual, Periodical (FDAP) income.

When you start a new job in the US, you will need to provide some important pre-employment documents to your employer.

These documents will ensure that the correct amount of tax is withheld from your salary. If these forms are not completed correctly, you could end up paying too much tax!

The US has signed tax treaty agreements with more than 65 countries around the world. If you are entitled to benefit from one of these agreements, you could potentially save a lot on your taxes.

When you create your Sprintax account, you can easily determine whether or not you are entitled to any tax treaty benefits.

- Your employment tax forms are generated for you

- Quickly identify your tax treaty eligibility

- Calculate your residency for tax purposes

- Determine if you are exempt from FICA taxes

- 24/7 Live Chat support to guide you all the way

International students, scholars, teachers, professors, researchers, trainees, physicians, au pairs, summer camp workers, and other non-students on F-1, J-1, M-1, Q-1 or Q-2 visas are typically entitled to a FICA exemption.

Sprintax Forms can help you determine whether you are exempt from FICA tax.

Yes! You can easily prepare your US Federal and State tax return online with Sprintax. Get started with your nonresident tax return here.