Sprintax for foreign investors

Tax preparation and compliance software for nonresidents in the US

File your investor tax return with Sprintax

Are you earning income from investments in the US? Sprintax Returns is a convenient platform from which you can prepare all of the tax return documents you need

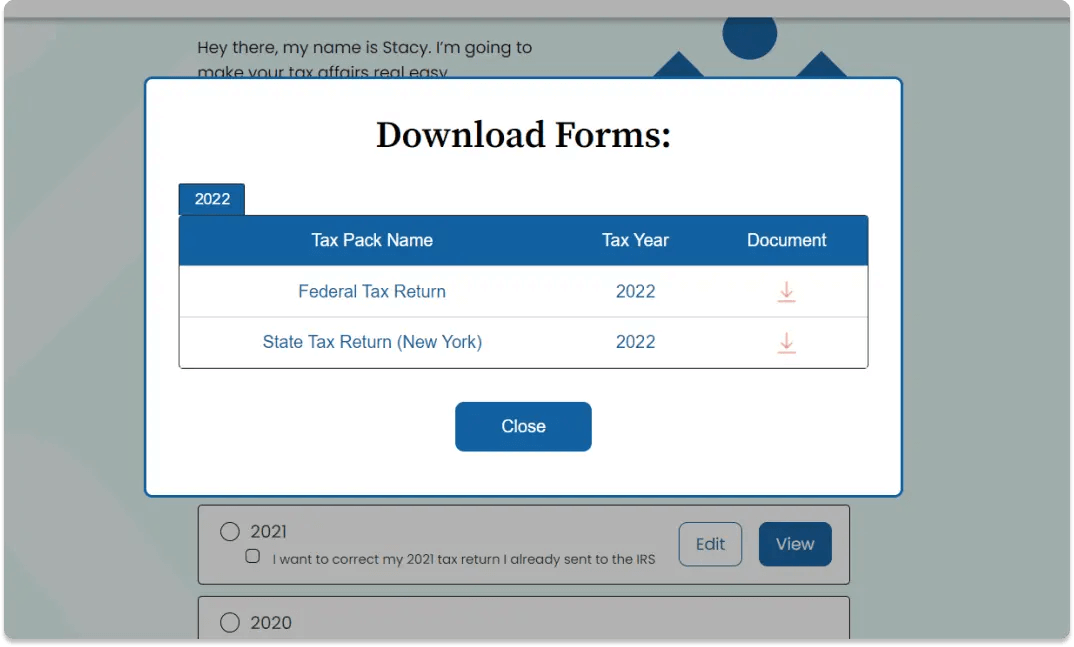

- Automatic generation of every tax document you need (including federal and state tax returns and form 8843)

- E-file your federal tax return

- Claim your tax treaty benefits

- 24/7 Live Chat support

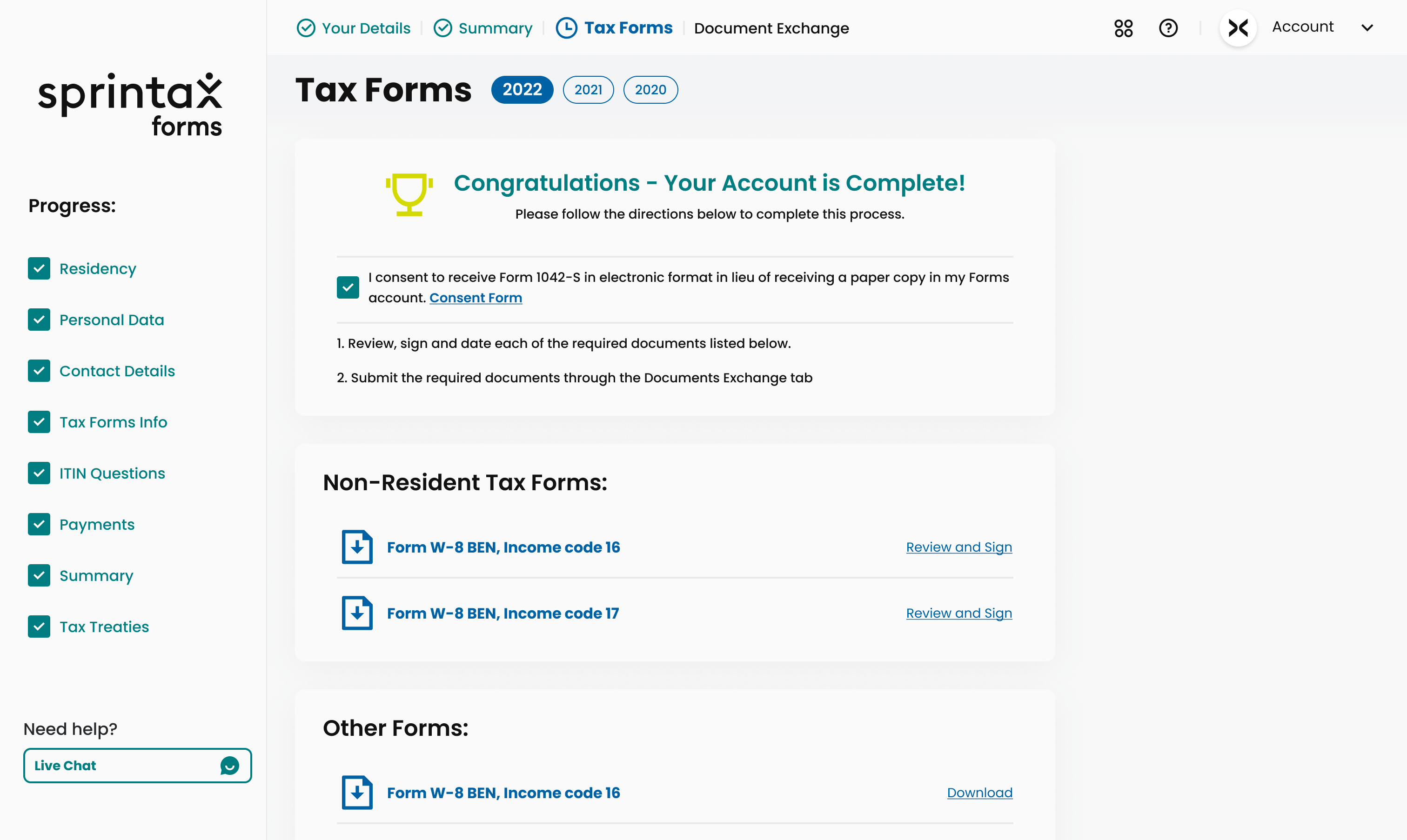

IRS compliance guaranteed with Sprintax Forms

Sprintax Forms will prepare you for tax season and ensure you have everything you need to file your investment tax return

- Prepare your Taxpayer Identification Number (Social Security Number or Individual Taxpayer Identification Number) easily online.

- Enjoy peace of mind as our software guarantees full compliance with the IRS.

Claiming a refund of Dividend Withholding Tax

Do you work for an overseas organisation in the US?

If you benefit from a stock or share agreement, it’s likely that you have paid Dividend Withholding Tax (DWT) abroad. Every year, many investors pay too much DWT and are entitled to a refund. Sprintax can guide you through the process of reclaiming your dividend withholding tax.

Learn MoreHere's What Our Customers Think

Go to site for preparing tax returns for non-residents.

- User friendly

- Very helpful customer care representatives who answer the smallest of your queries even if it is a peculiar case or some silly doubt

- Partners with all major universities to let the students fill the federal return free of cost

This is my review after using Sprintax for 5th year in a row!!

Mark is great! I have been struggling to pay my Federal Tax since April with different advisors trying their best to help. Finally today I was assisted by Mark who was nothing short of amazing! He sent me a solution which worked in seconds. Thank you so much Mark, you’ve relieved months of stress!

2nd time with Sprintax, 100% recommend! 2nd time processing my J-1 taxes and their service never failed me (got my last year’s refund already, now waiting for this year). Even their post-payment is amazing! Valentin helped me with all my questions and answered them in detail. Five-star service! This might be my last filing with them since I left USA already but 100% would recommend their services to any J-1 interns like me who want to file smoothly AND maximize their tax refund!

Foreign investors tax FAQs

Yes. If you earn income from investments while in the US as a nonresident, you will be required to pay tax on your income and file a tax return with the IRS.

If you make a profit through the sale of an asset – such as a property, car, stock or bond – you must pay capital gains tax (CGT). You will also be required to file a tax return to account for the CGT due.

Yes.

Tax could potentially be due on dividends you receive through a stock or share investment. By registering with Sprintax, you can easily determine exactly how much tax you are required to pay on all of your investment income.

Nonresident aliens who receive dividend payments are liable to pay tax at a rate of 30% on this income.

As a nonresident, if you receive interest income from deposits from a US bank, savings & loan institution, credit union, or insurance company, or you receive portfolio interest, you will be exempt from taxation as long as the interest is not connected with a US trade or business.