Sprintax for International Students

Tax software for students on F-1 and M-1 visa

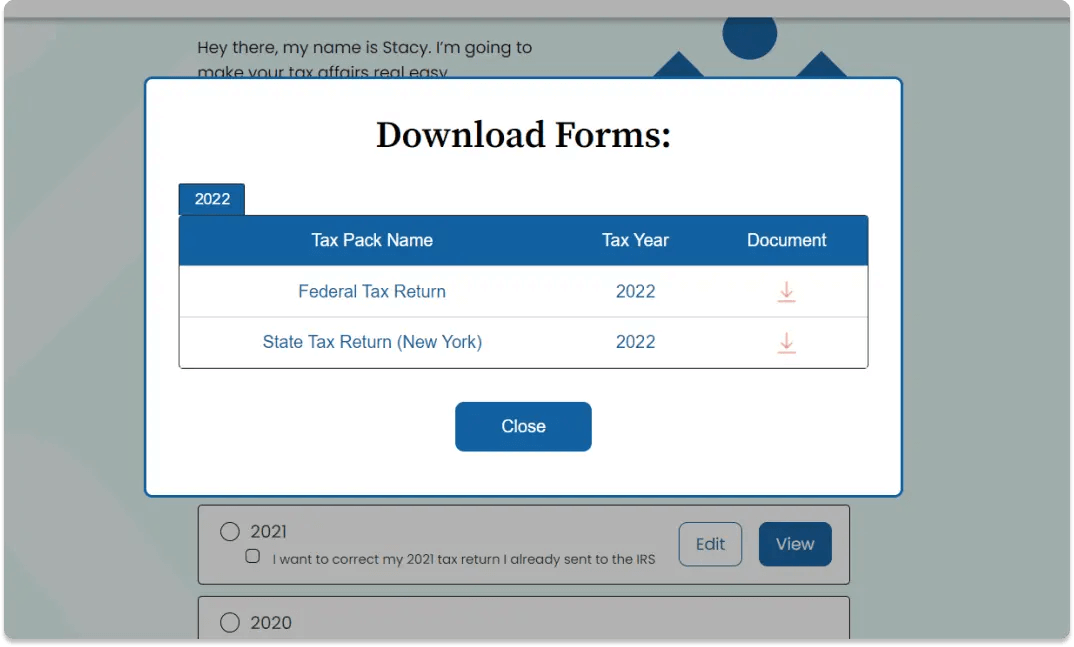

File your international student

tax return with Sprintax Returns

Tax filing for international students made easy

- Federal tax return E-Filing (form 1040NR)

- Preparation of state tax returns and Form 8843

- Fast tax residency determination (substantial presence test)

- Claim tax treaty benefits and other reliefs

- FICA tax refund application

$1,184

Average federal refund

1m+

Federal tax returns filed

650

School & corporate partners

203

Nationalities assisted

Tax preparation for OPT and CPT participants

Starting an Optional Practical Training (OPT) or Curricular Practical Training (CPT) placement? No doubt you’re excited to enjoy an invaluable work experience in the US.

But remember – if you earn income, you are required to pay tax in the US. You must also complete a W-4 tax form to ensure you pay the right amount of tax when you begin your placement. Sprintax will help you to prepare all of the documents you need for your OPT or CPT.

Our unique software will ensure you never pay any more tax than you need to. We’ll also help you to correctly prepare your US tax return before the filing deadline.

Learn More

Pay the correct amount of US income tax as an international student

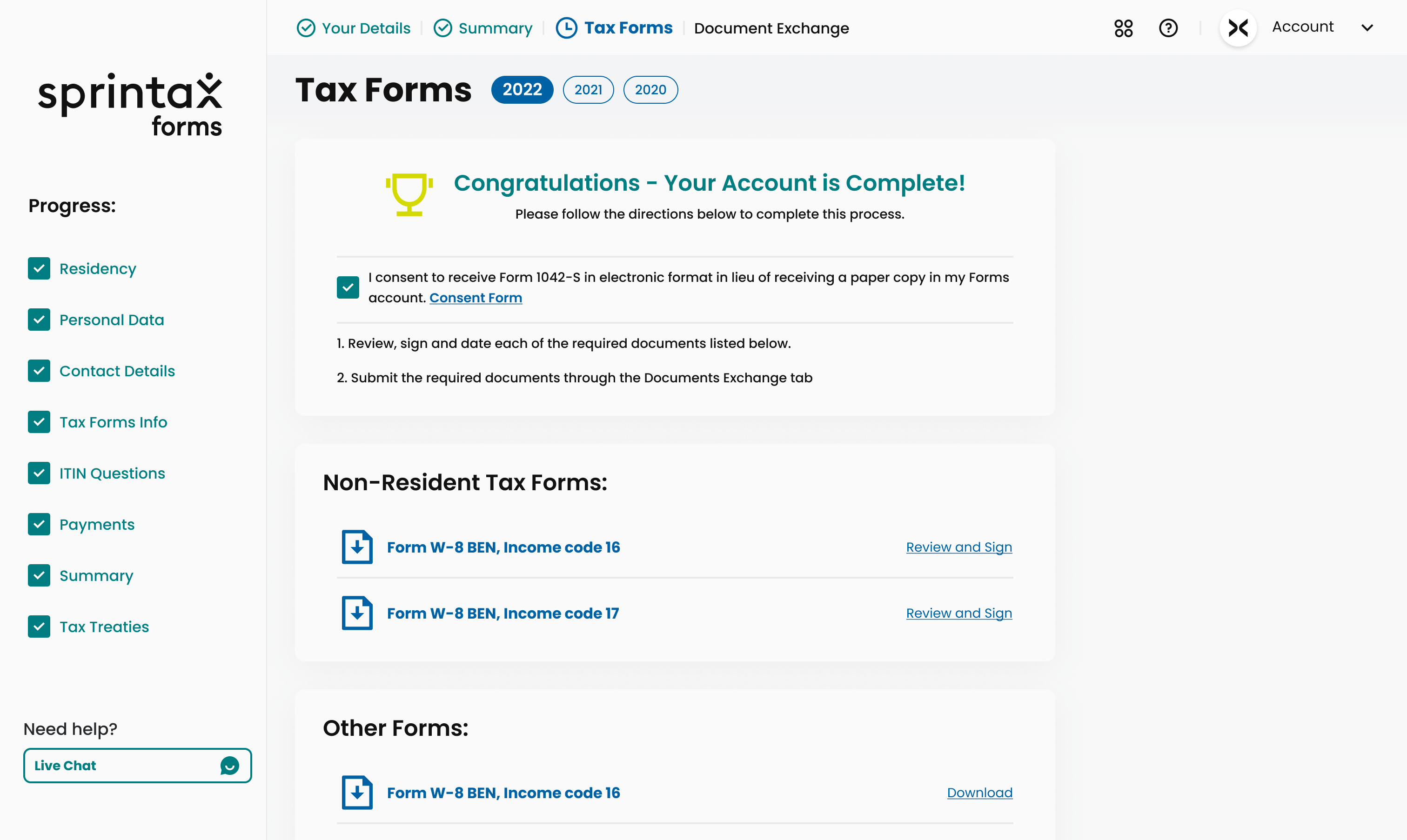

Prepare your pre-employment tax documents with Sprintax Forms when starting work on an F-1 visa

- Ideal tax solution for international students

- Easily prepare the employment forms you need (including W-4, 8233, W-8BEN and more)

- Avail of your tax treaty benefits

- Identify FICA exemptions

ITIN application for international students

If you’re not eligible for a Social Security Number – which may be the case if you are not authorised to work in the US – you will need to apply for an ITIN in order to file your tax return correctly. The IRS will use your ITIN to confirm your identity when processing your tax documents.

In order to apply for your ITIN, you must complete a W-7 form. But why worry about filling out these documents on your own? The Sprintax software has been designed specifically to guide you through your ITIN application.

Simple online application process

Every year, our Sprintax Forms solution helps thousands of international students to complete their W-7 form and secure their ITIN, stress-free.

Apply for your ITIN during tax season

Tax deadline fast approaching? With Sprintax Returns, you can easily file your ITIN application while your prepare your tax return documents.

How long do ITIN applications take?

During tax season (January – April), ITIN processing times can take many months. Therefore, it is a good idea to apply for your ITIN as early as possible. This will help to ensure you have the information you need to file your tax return before the deadline. In off-peak times, applications are typically processed within seven weeks.

Proud Partners

Tax tips for international students

What is Form 8233 and how do you file it?

The ultimate tax guide for international students on OPT

FICA tax explained for nonresident aliens

Here's What Our Customers Think

Go to site for preparing tax returns for non-residents.

- User friendly

- Very helpful customer care representatives who answer the smallest of your queries even if it is a peculiar case or some silly doubt

- Partners with all major universities to let the students fill the federal return free of cost

This is my review after using Sprintax for 5th year in a row!!

Mark is great! I have been struggling to pay my Federal Tax since April with different advisors trying their best to help. Finally today I was assisted by Mark who was nothing short of amazing! He sent me a solution which worked in seconds. Thank you so much Mark, you’ve relieved months of stress!

2nd time with Sprintax, 100% recommend! 2nd time processing my J-1 taxes and their service never failed me (got my last year’s refund already, now waiting for this year). Even their post-payment is amazing! Valentin helped me with all my questions and answered them in detail. Five-star service! This might be my last filing with them since I left USA already but 100% would recommend their services to any J-1 interns like me who want to file smoothly AND maximize their tax refund!

International student tax FAQs

Nonresident international students on F-1, J-1, M-1, Q-1 or Q-2 visas are entitled to an exemption from social security tax.

If you did not earn any income while in the US as an international student, you may not be required to file a federal tax return. However, at a minimum you will be required to file a form 8843. Sprintax will help you to determine the forms you are required to file.